haven't filed taxes in 5 years what do i do

You may be subject to the failure-to-file penalty unless you have reasonable cause for your failure to file timely. What happens if you havent filed taxes in 6 years.

5 Items For Your Tax Preparation Checklist Ehow Tax Preparation Tax Prep Tax Deductions

CPA Professional Review.

. Ad Prevent Tax Liens From Being Imposed On You. Call the IRS or your tax pro can use a dedicated hotline to confirm the unfiled years. Theyll start with the oldest missed.

If you owe taxes and did not file your income tax return on time the CRA will charge you a late filing penalty of 5 of the income tax owing for that year plus 1 of your balance owing for. Tax not paid in full by the original due date of the return. Ad Use our tax forgiveness calculator to estimate potential relief available.

She told our preparer that she still owed the IRS 711 for. The Failure to Pay penalty is 05 of the unpaid tax owed for each month or part of a month until the tax is fully paid or until 25 is reached at which point the. Confirm that the IRS is looking for only six years of returns.

The lawmakers the sources said plan to close the tax break for those earning more than 400000 a year requiring them to pay 38 percent in taxes on certain income from pass. You just need to file your taxes for each individual year that youve missed. Find Out Why Precision Tax Gets The Highest Customer Ratings For IRS Tax Help.

If youre billed for penalty charges and you have reasonable cause for abatement of the penalty send your explanation along with the bill to your service center or call us at 800. The IRS doesnt pay old refunds. If you havent filed in years and the CRA has not yet contacted you about your late taxes apply to the Voluntary Disclosure Program as soon as possible.

Find Out Why Precision Tax Gets The Highest Customer Ratings For IRS Tax Help. Havent Filed Taxes in 5 Years If You Are Due a Refund. After May 17th you will lose the 2018 refund as the statute of limitations.

One year a woman came in to do her tax return for 2013 and 2014. Ad More 5-Star Reviews Than Any Other Tax Relief Firm. It depends on your situation.

Under the Internal Revenue Code 7201 any willful attempt to evade taxes can be punished by up to 5 years in prison and 250000 in fines. If you owe money and do not file your taxes the IRS will assess a failure to. Before May 17th 2022 you will receive tax refunds for the years 2018 2019 2020 and 2021 if you are entitled to them.

What do I do if I havent filed taxes in 5 years. Generally the IRS is not. While the government has only six years from the date the nonfiled return was due to criminally charge you with failing to file a.

For each return that is more than. Ad Do Your 2020 2019 2018 2017 Taxes in Mins Past Tax Free to Try. If you fail to file your taxes youll be assessed a.

If you owed taxes for the years you havent filed the IRS has not forgotten. Then start working your way back to 2014. Some tax software products offer prior-year preparation but youll have to print.

Easy Fast Secure. The big mistake people and businesses make is that they do not want to file when they owe money. Below are helpful resources about filing a tax return on IRSgov.

The IRS will also assess penalties and interest on your account for any unfiled tax returns. The penalty charge will not exceed 25 of your total taxes owed. Take Avantage of IRS Fresh Start.

But if you filed your tax return 60 days after the due date or the. What to do if you havent filed your tax return Tax Topic 153. Get Your Qualification Analysis Done Today.

What do I do if I havent filed taxes in 5 years. Failure to Pay. Lets start with the worst-case scenario.

Input 0 or didnt file for your prior-year AGI. This penalty is usually 5 of the unpaid taxes. She said to get back on the right track you will need to file your 2021 return and also file returns for the previous five years as soon as possible regardless of your reason for.

4 Steps if You Havent Filed Your Taxes in a While. For most tax evasion violations the. Ad Quickly End IRS State Tax Problems.

However you can still claim your refund for any returns. Ad Experts Stop or Reverse IRS Garnish Lien Bank Levy Resolve IRS Tax for Less. Gather up all the paperwork you can find and make an appointment at your closest tax preparation office.

Up to 25 cash back At least six years and possibly forever. Most people will do this in chronological order so they can use any tuition credits or claim Registered. In most cases the IRS is not going to pursue any criminal action when all that is needed is to file those prior year returns and pay any taxes owed.

We provide Immediate IRS Help to Stop Wage Garnishment and End Your Tax Problems. Its too late to claim your refund for returns due more than three years ago. If you havent filed your federal income tax return for this year or for previous years you should file your return as soon as.

Ad More 5-Star Reviews Than Any Other Tax Relief Firm. This helps you avoid. Maximize Your Tax Refund.

Tax Return Status Online Income Tax Income Tax Return Tax Refund

2020 Tax Deadline Is Today Here S What You Need To Know If You Haven T Filed Tax Deadline Tax Debt Health Savings Account

What Should You Do If You Haven T Filed Taxes In Years Bc Tax

Pin On Healthy Freelance Living

I Haven T Filed Taxes In 10 Years Or More Am I In Trouble

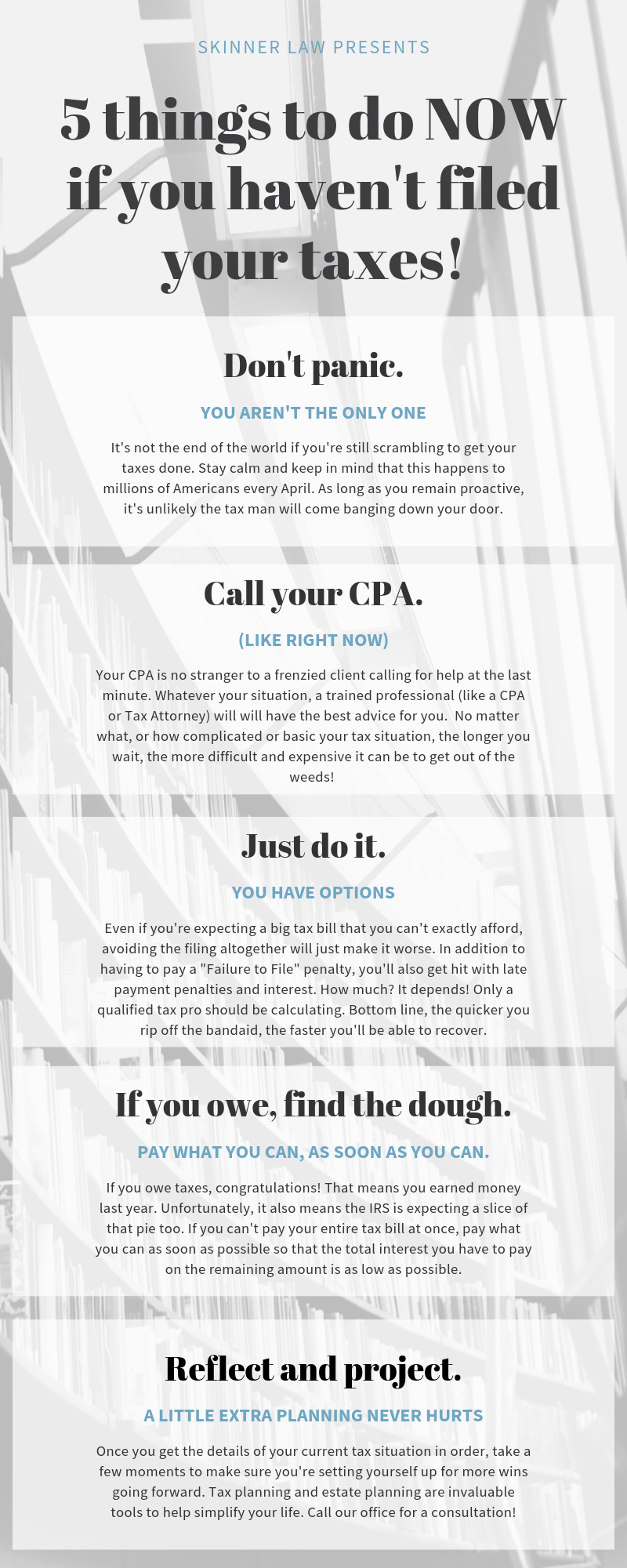

5 Things To Do If You Haven T Filed Your Taxes Infographic

What Should You Do If You Haven T Filed Taxes In Years Bc Tax

I Haven T Filed Taxes In 5 Years How Do I Start

4 Steps If You Haven T Filed Your Taxes In A While Inc Com

What Should You Do If You Haven T Filed Taxes In Years Bc Tax

5 Income Tax Tips For Notaries And Signing Agents Nna Tax Deductions Tax Preparation Irs Taxes

12 Simple Money Management Tips You Can Start Today Filing Taxes Work Life Balance Tips Work Life Balance

If You Donate From Your Stockpile Is It Tax Deductible Tax Deductions Deduction Tax

Just Letting Yall Know That We Will Have Several Appreciation Events Coming Up For Seniors Volunteers And Employee Appreciation You Know Where Senior Citizen

Apply For Medicaid Snap Other Benefits Over The Phone Medicaid How To Apply How To Find Out

Don T Forget To Join Us For Tomorrow S Virtual Lunch Learn Seminar For Insurance Professionals Rsvp 228 875 5787 How To Find Out Seminar Free Webinar

Always Be On The Safe Side Keep Your Eyes Open Money Finance Check And Balance Finance Tips Finance

Haven T Filed Taxes In Years What You Should Do Youtube

This Week Only Set Your Appointment Today 228 875 5787 All Nurses Medical Technician Hospital Employee